Highly Rated hard money lenders in Atlanta Georgia You Can Count On

Highly Rated hard money lenders in Atlanta Georgia You Can Count On

Blog Article

The Effect of a Hard Money Financing on Real Estate Financing Strategies

In the complex arena of actual estate financing, hard Money fundings have emerged as a potent device, supplying investors a quick path to capital. Understanding the complexities of tough Money car loans is crucial for capitalists looking to make best use of returns while mitigating dangers.

Understanding the Idea of Hard Money Loans

Although typically misunderstood, difficult Money finances play a critical role in the genuine estate field. They are short-term fundings given by personal investors or business, based on the value of the property being purchased instead of the consumer's credit reliability. The funds are usually made use of for remodelling or building and construction of realty residential or commercial properties. These car loans are defined by their high rate of interest prices and much shorter repayment durations contrasted to typical loans. Tough Money financings are commonly the go-to alternative genuine estate investors that require quick financing or those with bad credit rating. Recognizing the intricacies of hard Money finances is crucial for any investor or developer as it can open up new avenues for residential property financial investment and growth.

The Benefits and drawbacks of Hard Money Loans in Real Estate

Hard Money fundings in property come with their one-of-a-kind collection of advantages and potential threats (hard money lenders in atlanta georgia). A close exam of these aspects is essential for financiers interested in this kind of financing. The following conversation will intend to clarify the benefits and drawbacks, providing an extensive understanding of hard Money car loans

Evaluating Hard Money Advantages

Regardless of the prospective obstacles, hard Money lendings can supply significant advantages for real estate financiers. The key advantage lies in the speed and convenience of obtaining these finances. Unlike traditional lenders, difficult Money lenders do not focus on the debtor's credit reliability. Rather, they focus on the residential or commercial property's worth. This suggests that Funding approval and funding can occur within days, not months or weeks. Furthermore, hard Money fundings supply flexibility. Customized Finance terms can be worked out based on the financier's special requirements and project specifics. One more benefit is the lack of income confirmation. For capitalists with uneven revenue yet significant equity in their home, this can be a genuine advantage. These benefits must be weighed against potential downsides, which will certainly be discussed later.

Recognizing Possible Funding Risks

While tough Money finances provide enticing advantages, it is vital to understand the integral dangers involved. First of all, the high rate of interest and short settlement periods can place customers in a precarious monetary scenario if they stop working to create a quick return on financial investment. Additionally, the residential property, which acts as the Loan security, is at stake if settlement stops working. Also, difficult Money lenders, unlike typical banks, are not constantly based on the same guidelines and oversight. This lack of law can potentially subject customers Our site to misleading loaning methods. The approval of a Hard Money Funding is mostly based on the residential or commercial property value, not the consumer's credit reliability, which can encourage risky financial habits.

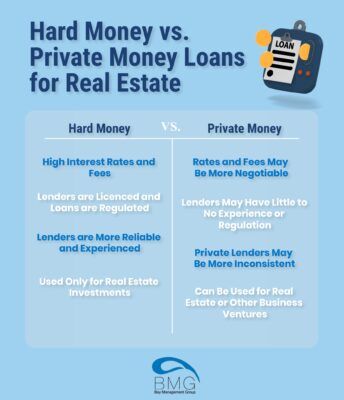

Comparing Tough Money Financings With Typical Funding Alternatives

How do hard Money financings contrast with traditional financing choices in the genuine estate market? Difficult Money financings, frequently sought by financiers for fast, temporary funding, are identified by their rapid authorization and financing procedure. Tough Money car loans normally have a much shorter term, generally around 12 months, while typical loans can extend to 15 to 30 years.

Situation Studies: Successful Real Estate Deals Funded by Hard Money Loans

In another situation, an actual estate financier in Miami was able to shut a deal on a multi-unit household building within days, many thanks to the fast approval process of a Hard Money Loan. These situations underline the role tough Money financings can play in assisting in profitable actual estate deals, testifying to their strategic significance in actual estate funding.

How to Protect a Hard Money Loan: A Step-by-Step Guide

Safeguarding a Hard Money Lending, much like the Austin designer and Miami financier did, can be a substantial game-changer in the property market. The initial step entails recognizing a credible tough Money lender. In this context, the customer ought to think about variables such as openness, rates of interest, and handling rate. After choosing a lender, the borrower must present a compelling case, generally by showing the prospective productivity of the residential property and their capability to settle the Lending. Required documents, consisting of credit rating and evidence of revenue, might also be called for. As soon as the loan provider accepts the proposal and assesses, the Loan contract is drawn up, signed, and funds are disbursed. The process, while apparently overwhelming, can be look at here now navigated with due persistance and preparation.

Tips for Making Best Use Of the Advantages of Hard Money Loans in Property Financial Investment

To make use of the complete possibility of difficult Money finances in real estate financial investment, savvy capitalists employ a range of techniques. One such method involves using the fast approval and funding times of hard Money have a peek at this site car loans to maximize profitable bargains that call for fast action. Another method is to use these financings for residential property renovations, consequently enhancing the value of the home and potentially accomplishing a higher list price. Capitalists need to likewise bear in mind the Financing's conditions, guaranteeing they appropriate for their financial investment strategies. It's prudent to develop healthy and balanced connections with hard Money loan providers, as this can lead to a lot more desirable Funding terms and possible future funding possibilities. These strategies can maximize the benefits of hard Money car loans in the real estate market.

Conclusion

In conclusion, difficult Money car loans can be a powerful tool in an actual estate capitalist's funding collection, supplying quick access to capital and assisting in revenue generation from remodelling or procurement jobs. Their high-cost nature necessitates thorough due persistance and tactical planning. Capitalists have to guarantee that potential returns validate the associated risks which they have the ability to take care of the brief payment timelines successfully.

These financings are defined by their high rate of interest prices and shorter payment durations compared to typical loans. Tough Money car loans are frequently the best alternative for real estate capitalists who require fast financing or those with poor credit scores history (hard money lenders in atlanta georgia). Understanding the intricacies of difficult Money loans is essential for any type of genuine estate investor or programmer as it can open up new opportunities for home investment and advancement

Tough Money finances normally have a shorter term, generally around 12 months, while conventional fundings can prolong to 15 to 30 years. These scenarios highlight the function hard Money financings can play in helping with lucrative real estate deals, proving to their critical relevance in actual estate funding.

Report this page